inheritance tax rate indiana

For more information check our list of inheritance tax forms. Indiana used to impose an inheritance tax.

Indiana Estate Tax Everything You Need To Know Smartasset

The Iowa tax only applies to inheritances resulting from estates worth more than 25000.

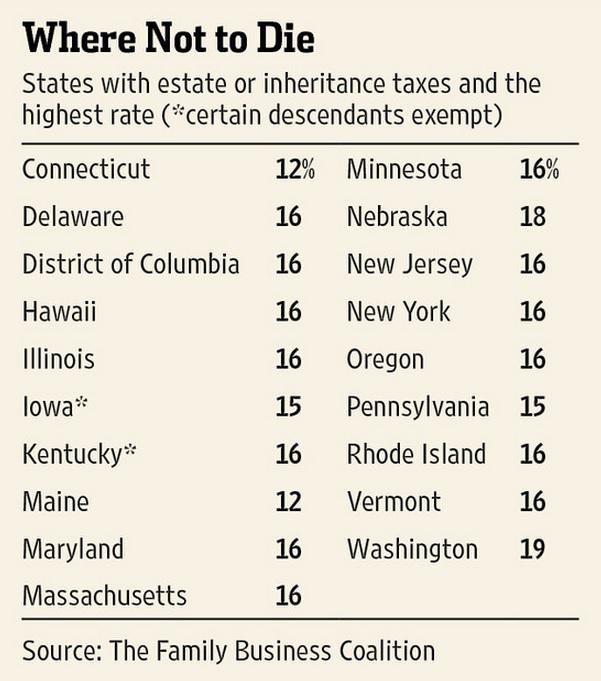

. The state does not tax Social Security benefits. Indiana has a three class inheritance tax system and the exemptions and tax rates. The top estate tax rate is 16 percent exemption.

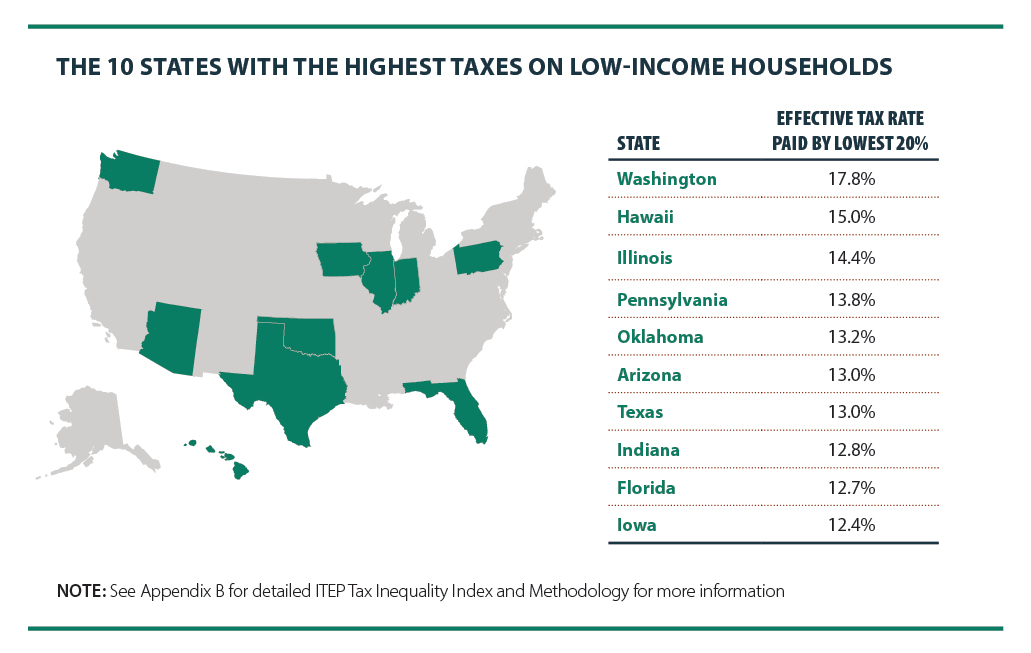

Note that historical rates and tax laws may differ. Overall Indiana Tax Picture. Heres a breakdown of each states inheritance tax rate ranges.

Below are the ranges of inheritance tax rates for each state in 2021 and 2022. For deaths occurring in 2013 or later you do not need to worry about. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021.

Indiana repealed the inheritance tax in 2013. The Indiana individual adjusted gross income tax rate is 323. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing.

It fully taxes withdrawals from retirement accounts. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. In Maryland the tax is only levied if the estates total value is more than 30000.

Up to 25 cash back Update. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. The Indiana law imposed an inheritance tax at progressive rates upon lineal and collateral relatives as well as strangers.

A strong estate plan starts with life. Indiana inheritance tax was eliminated as of January 1 2013. As of 2018 an individual can give another person up to 15000 per year as a gift tax-free.

Corporate and sales tax rates County tax rates County innkeepers tax Food-and-beverage rates and effective. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. Any more than that in a year and you might have to pay a certain percentage of taxes.

Counties charge the same tax rate for residents and non-residents. Inheritance tax was repealed for individuals dying after December 31 2012. Ohios estate tax was repealed effective January 1 2013.

Note that these rates are paid in. The top estate tax rate is 16 percent exemption threshold. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property.

This tax ended on December 31 2012. No estate tax or inheritance tax. Both state estate taxes and state inheritance taxes have been on the chopping block lately.

The table below shows the income tax rates for all 92 Indiana counties. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. There is no federal inheritance tax but there is a federal estate tax.

Indiana is moderately tax-friendly for retirees. The act was amended in 1915 1917and 1919. Indiana repealed the inheritance tax in 2013.

Trump S Tax Plan What Is The Death Tax And How Would It Change

Dor Completing An Indiana Tax Return

States With Inheritance Tax Or Estate Tax Bookkeepers Com

New York S Death Tax The Case For Killing It Empire Center For Public Policy

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Estate And Inheritance Taxes Around The World Tax Foundation

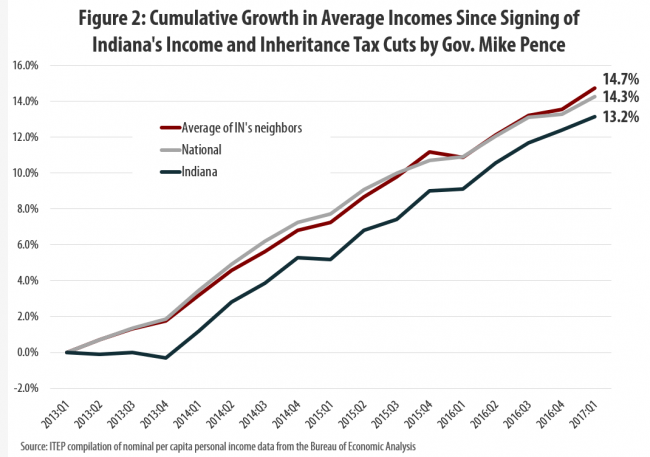

Indiana S Tax Cuts Under Mike Pence Are Not A Model For The Nation Itep

Fact Check Death Tax Talking Point Won T Die

More Than Half Of America S 100 Richest People Exploit Special Trusts To Avoid Estate Taxes Propublica

Dor Unemployment Compensation State Taxes

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The Ethics Of Taxation Trilogy Part I Seven Pillars Institute

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Death Tax Taxes On Death American Legislative Exchange Council American Legislative Exchange Council